Advantages of Commercial Papers in SwiftBooks: Flexible and Efficient Check Management

Introduction

In today’s business world, commercial papers such as received and issued checks are among the primary financial tools used to manage monetary transactions between different parties. Checks are not only a payment method but also serve as financial guarantees that enhance trust between entities. With the diverse financial needs of businesses and the increasing volume of transactions, the demand for technological solutions that provide flexible and efficient management of commercial papers has risen significantly.

The SwiftBooks program offers an advanced solution for managing all types of checks. It allows businesses to track financial transactions accurately and effortlessly while providing flexible tools to handle all operations related to commercial papers. This article will explore the advantages of SwiftBooks and how it simplifies financial operations while improving the efficiency of check management.

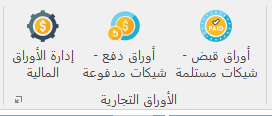

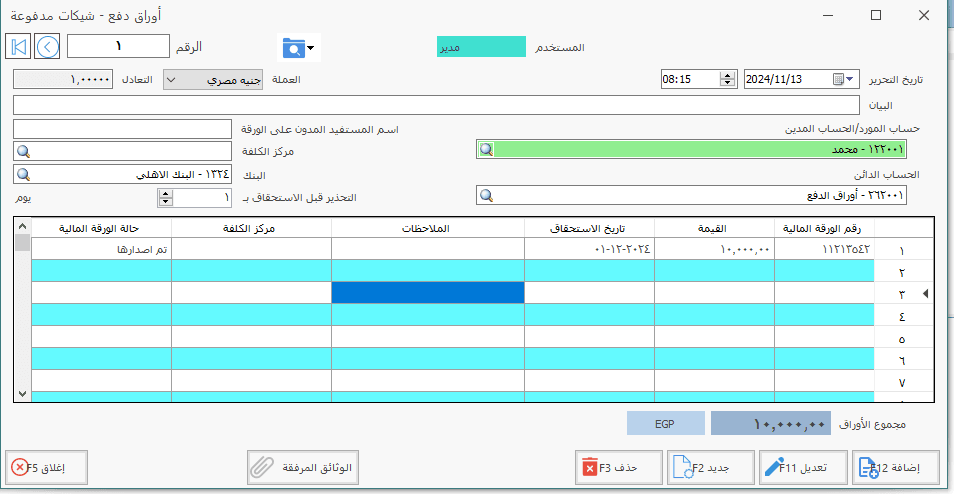

1. Easy Addition of Received or Issued Checks

SwiftBooks enables users to easily record and track checks, whether received or issued. Users can input all essential details such as the check number, receipt date, and due date, ensuring data accuracy and facilitating future reference.

- Received Check: Users can input details of checks received from clients, such as the check number, amount, due date, and the bank account where the amount will be deposited upon clearance.

- Issued Check: Users can input details of checks issued to suppliers or other entities, such as the amount, due date, and the bank account from which the amount will be deducted upon payment.

2. Linking Commercial Papers to Banks

SwiftBooks allows users to link commercial papers to specific banks without requiring direct integration with bank accounts. This provides flexibility in defining the financial operations that will be executed based on the commercial paper details.

- For received checks: The amount is automatically added to the specified bank account upon clearance of the check.

- For issued checks: The amount is deducted from the specified bank account when the payment is processed.

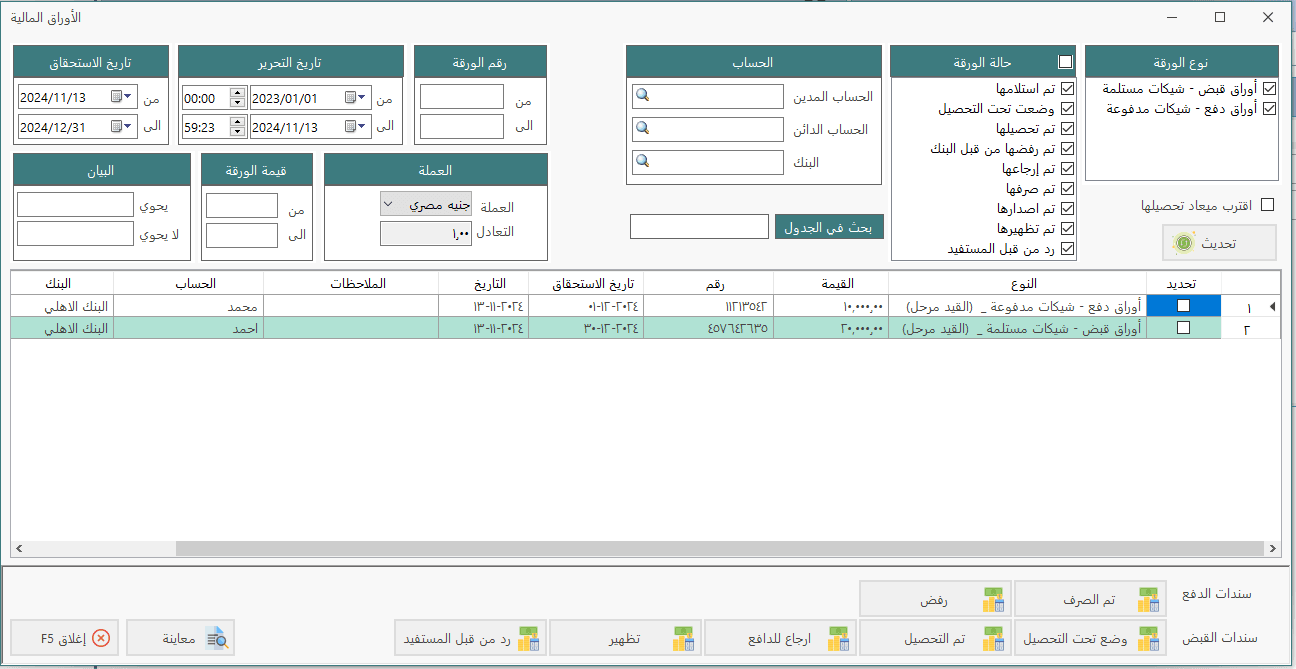

3. Efficient Management of Commercial Papers

SwiftBooks provides a comprehensive module for managing commercial papers, allowing users to seamlessly track all received and issued checks. Users can categorize checks based on due dates or statuses, such as (Pending Collection, Rejected, Collected, Paid), offering a complete and accurate view of all financial transactions.

Key Features:

- Check Collection: Checks are automatically updated to “Collected” status upon clearance, ensuring accurate record-keeping.

- Rejected Checks: In the case of a rejected check, users can record this easily and add notes, ensuring that records remain accurate.

- Adding Fees: The program allows users to add fees automatically, such as bank or collection fees, without requiring manual calculations.

4. Reviewing Checks and Their Status at Any Time

SwiftBooks makes it easy to review and check the status. Users can view whether a check is accepted, rejected, collected, or pending, along with comprehensive details such as receipt date, due date, and collection date.

5. Easy Export of Reports

SwiftBooks allows the export of detailed reports on commercial papers in various formats such as PDF and Excel. These reports contain comprehensive data on all received and issued checks, facilitating financial performance monitoring and precise analysis.

6. Automated Notifications and Alerts

The notification feature in SwiftBooks helps users avoid delays in financial transactions. Alerts can be activated to remind users of check due dates or notify them of rejected checks, ensuring compliance with payment and collection schedules.

7. Easy Account Reconciliation

SwiftBooks allows for efficient account reconciliation through its user-friendly interface if there are delays in check collection or rejected checks. The program enables users to update the check status or record refund transactions, maintaining accurate financial records.

8. Data Security and Protection

SwiftBooks places a high priority on data security. All financial transactions related to commercial papers are secured using advanced technologies to protect information from breaches or leaks. Additionally, the program provides user-specific permissions to ensure data privacy and restrict access to sensitive information.

Conclusion

The SwiftBooks program offers an innovative and effective solution for managing commercial papers such as received and issued checks. With features like easy data entry, bank linking, check status management, automatic fee addition, and detailed reporting, businesses can streamline financial transactions and achieve greater accuracy in money management. With robust data security and flexible tools, SwiftBooks is the ideal choice for businesses aiming to simplify payment and collection processes while ensuring efficient and secure check management.

Read more:

- The Crucial Role of Financial Accounting in Business Success Using Advanced Accounting Software

- What is Capital and How to Manage it Efficiently Using Swiftbooks

- Best Accounting Software in Egypt 2024 – Comparison and User Reviews: Swiftbooks

- The Best Accounting System for Various Business Operations: The Ultimate Solution for Achieving Business Success in 2024

Programs and Services:

-

- Learn more about Swiftbooks

- E-invoice software to facilitate the submission of direct invoices and sales tax authorities

- Discover our comprehensive services for your business